Powhatan Property Taxes . Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. Access property assessments, tax document retrieval, and online. powhatan’s tax rates are as follows: real estate tax rate. search our database of free powhatan residential property records including owner names, property tax assessments &. discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. the powhatan county tax collector is responsible for collecting property tax from property owners.

from www.formsbank.com

Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. the powhatan county tax collector is responsible for collecting property tax from property owners. real estate tax rate. search our database of free powhatan residential property records including owner names, property tax assessments &. discover powhatan county, va tax records and services. Access property assessments, tax document retrieval, and online. powhatan’s tax rates are as follows: the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value.

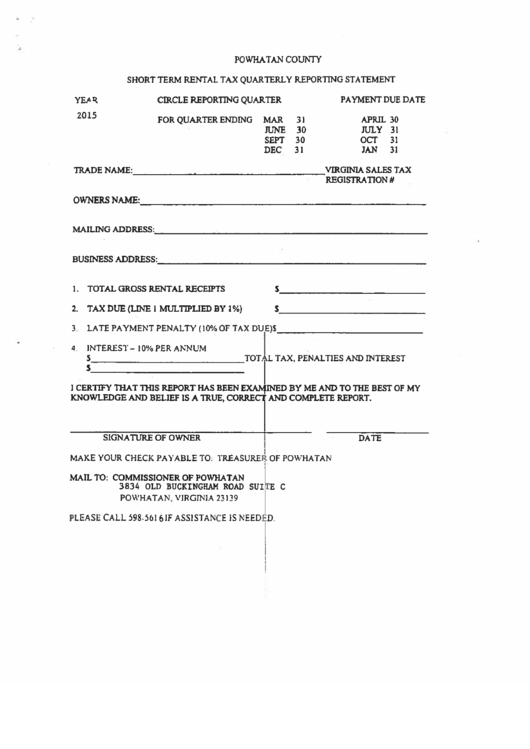

Short Term Rental Tax Quarterly Reporting Statement 2015 Powhatan

Powhatan Property Taxes powhatan’s tax rates are as follows: real estate tax rate. Access property assessments, tax document retrieval, and online. search our database of free powhatan residential property records including owner names, property tax assessments &. powhatan’s tax rates are as follows: the powhatan county tax collector is responsible for collecting property tax from property owners. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value.

From www.realtor.com

Powhatan, VA Real Estate Powhatan Homes for Sale Powhatan Property Taxes Access property assessments, tax document retrieval, and online. the powhatan county tax collector is responsible for collecting property tax from property owners. discover powhatan county, va tax records and services. real estate tax rate. powhatan’s tax rates are as follows: search our database of free powhatan residential property records including owner names, property tax assessments. Powhatan Property Taxes.

From www.realtor.com

Powhatan, VA Real Estate Powhatan Homes for Sale Powhatan Property Taxes powhatan’s tax rates are as follows: Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. discover powhatan county, va tax records and services. Access property assessments, tax document retrieval, and online. the powhatan county tax collector is responsible for collecting property tax from property owners. the median property tax (also. Powhatan Property Taxes.

From www.landwatch.com

Powhatan, Powhatan County, VA Undeveloped Land for sale Property ID Powhatan Property Taxes Access property assessments, tax document retrieval, and online. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. real estate tax rate. the powhatan county tax collector is responsible for collecting property tax from property owners. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per. Powhatan Property Taxes.

From powhatanliving.com

Explore Powhatan Real Estate & Community Powhatan Property Taxes real estate tax rate. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. powhatan’s tax rates are as follows: the powhatan county tax collector is responsible for collecting property tax from property owners. Real estate valuation (assessment) and the establishment of the. Powhatan Property Taxes.

From www.redfin.com

1540 Deborah Ln, Powhatan, VA 23139 MLS 1509168 Redfin Powhatan Property Taxes Access property assessments, tax document retrieval, and online. real estate tax rate. the powhatan county tax collector is responsible for collecting property tax from property owners. search our database of free powhatan residential property records including owner names, property tax assessments &. powhatan’s tax rates are as follows: discover powhatan county, va tax records and. Powhatan Property Taxes.

From www.pinterest.co.uk

Powhatan County, Virginia, Map, 1911, Rand McNally, Michaux, Huguenot Powhatan Property Taxes Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. the powhatan county tax collector is responsible for collecting property tax from property owners. Access property assessments, tax document retrieval, and online. real estate tax rate. search our database of free powhatan residential property records including owner names, property tax assessments &.. Powhatan Property Taxes.

From www.neilsberg.com

Powhatan County, VA Median Household By Age 2023 Neilsberg Powhatan Property Taxes Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. discover powhatan county, va tax records and services. search our database of free powhatan residential property records including owner names, property tax assessments &. real estate tax rate. powhatan’s tax rates are as follows: the median property tax (also known. Powhatan Property Taxes.

From www.yespowhatan.com

Local Government Powhatan County EDA Powhatan Property Taxes real estate tax rate. search our database of free powhatan residential property records including owner names, property tax assessments &. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. powhatan’s tax rates are as follows: discover powhatan county, va tax records. Powhatan Property Taxes.

From www.forsaleatauction.biz

Powhatan County, VA Sale of Tax Delinquent Real Estate Powhatan Property Taxes search our database of free powhatan residential property records including owner names, property tax assessments &. real estate tax rate. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. Access property assessments, tax document retrieval, and online. the powhatan county tax collector is responsible for collecting property tax from property owners.. Powhatan Property Taxes.

From ar.inspiredpencil.com

Powhatan Map Powhatan Property Taxes real estate tax rate. discover powhatan county, va tax records and services. powhatan’s tax rates are as follows: the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. Access property assessments, tax document retrieval, and online. the powhatan county tax collector is. Powhatan Property Taxes.

From www.landwatch.com

Powhatan, Powhatan County, VA House for sale Property ID 418198863 Powhatan Property Taxes discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. real estate tax rate. search our database of free powhatan. Powhatan Property Taxes.

From www.financestrategists.com

Find the Best Tax Preparation Services in Powhatan County, VA Powhatan Property Taxes the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. search our database of free powhatan residential property records including owner names, property tax assessments &. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. discover powhatan county,. Powhatan Property Taxes.

From www.yespowhatan.com

Taxes Powhatan County EDA Powhatan Property Taxes the powhatan county tax collector is responsible for collecting property tax from property owners. powhatan’s tax rates are as follows: search our database of free powhatan residential property records including owner names, property tax assessments &. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. the median property tax (also. Powhatan Property Taxes.

From fill.io

Fill Free fillable Form 2020 COUNTY VIRGINIA POWHATAN BACK PERSONAL Powhatan Property Taxes Access property assessments, tax document retrieval, and online. powhatan’s tax rates are as follows: discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. Real estate valuation (assessment) and the establishment of the tax rate are. Powhatan Property Taxes.

From www.landwatch.com

Powhatan, Powhatan County, VA Undeveloped Land for sale Property ID Powhatan Property Taxes powhatan’s tax rates are as follows: search our database of free powhatan residential property records including owner names, property tax assessments &. real estate tax rate. Access property assessments, tax document retrieval, and online. discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county. Powhatan Property Taxes.

From www.forsaleatauction.biz

Powhatan County, VA Sale of Tax Delinquent Real Estate Powhatan Property Taxes the powhatan county tax collector is responsible for collecting property tax from property owners. discover powhatan county, va tax records and services. real estate tax rate. search our database of free powhatan residential property records including owner names, property tax assessments &. the median property tax (also known as real estate tax) in powhatan county. Powhatan Property Taxes.

From www.landwatch.com

Powhatan, Powhatan County, VA Lakefront Property, Waterfront Property Powhatan Property Taxes discover powhatan county, va tax records and services. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. Real estate valuation (assessment) and the establishment of the tax rate are 2 separate functions. real estate tax rate. Access property assessments, tax document retrieval, and. Powhatan Property Taxes.

From www.landwatch.com

Powhatan, Powhatan County, VA House for sale Property ID 417836008 Powhatan Property Taxes search our database of free powhatan residential property records including owner names, property tax assessments &. the median property tax (also known as real estate tax) in powhatan county is $1,928.00 per year, based on a median home value. Access property assessments, tax document retrieval, and online. Real estate valuation (assessment) and the establishment of the tax rate. Powhatan Property Taxes.